Our holistic approach to wealth management combines custom portfolio strategies with disciplined investment management to meet all of your financial needs.

- Personalized Portfolio Construction

- Investment Approach

- Investment Process

At the onset, clients meet with our experienced Relationship Managers who designs custom portfolio strategies that reflect clients' unique needs and goals.

Highstreet Pooled Funds are exclusively managed by AGF’s quantitative investment management team.

Quantitative Investing

Quantitative research is a powerful especially in today’s environment where the quantity of investment data is growing exponentially and the need to differentiate investible information from ‘noise’ has never been more important. For the team, it’s both a scientific approach used to prove investment concepts and a tool to narrow down financial information through a disciplined, repeatable investment framework.

Investment Approach

With a relentless passion for research, the team collectively believes that in quantitative approaches, it’s the people behind the strategies that truly drives innovation.

Empirical Research:

An in-house research platform enables the team to define factors, build risk models and portfolio optimizations tailored for the unique investment objectives of each strategy, keeping pace with their ideas and the ever-evolving market.

Philosophy:

Investment decisions are not fully driven by quantitative models. The opportunities and concepts highlighted by the team’s models are further verified and validated through fundamental analysis.

Culture:

Team approach towards continuous improvement and challenging of the investment process. They dig and dissect, discuss and debate, before coming to a decision, no matter what the data may say.

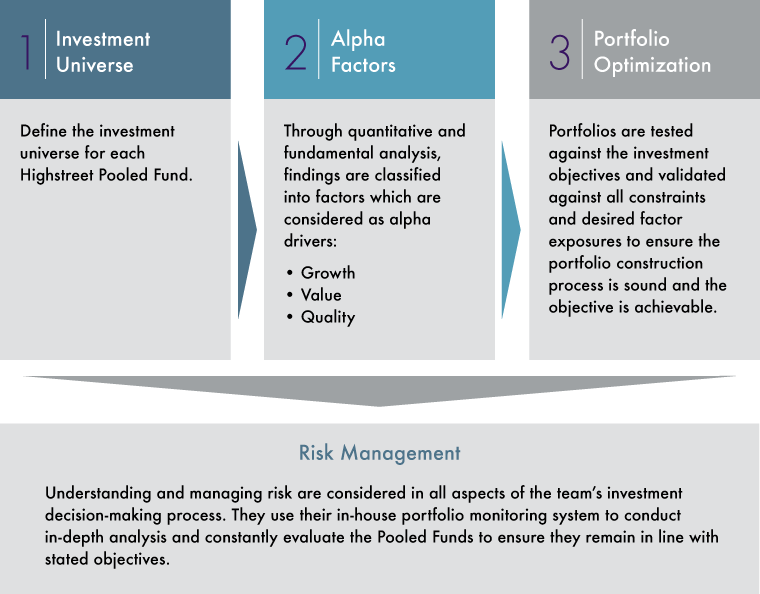

The investment team of the Highstreet Pooled Funds strives to develop and apply disciplined processes that are transparent and repeatable to achieve investment objectives.

When developing an investment strategy, the following roadmap provides the team with the best opportunity to target the factors that drive market returns, actively manage risk and provide better risk-adjusted returns.