| Portfolio | Highstreet U.S. Equity Fund |

| Lead Portfolio Manager | Robert Yan |

| Benchmark | S&P 500 Total Return Index |

| Fund Report | August 2025 |

Objective

The investment objectives of the Fund are to provide investors with:

- Long-term capital appreciation by investing in a diversified portfolio of U.S. equities of varying market capitalizations

- A long-term rate of return in excess to the benchmark

- A risk profile similar to the benchmark

Process

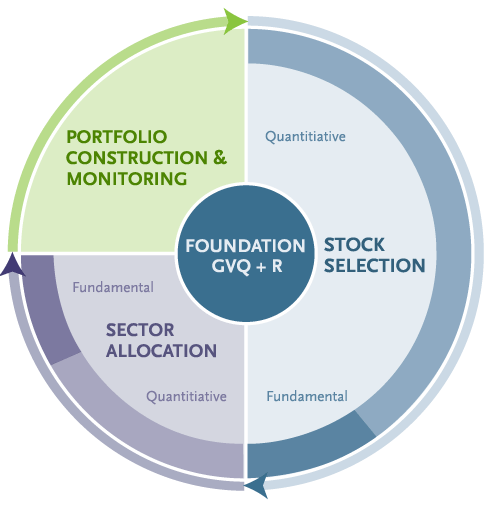

The Fund follows a disciplined, quantitative investment approach.

The investment team’s enhanced Canadian Equity process is designed to generate alpha through:

- Stock Selection through sector-specific models

- Sector allocation

- Portfolio construction and monitoring

A bottom-up stock selection approach employing Valuation, Asset Growth, Quality and Market Reaction is the foundation of the Fund’s investment process.

Performance Overview - Annualized Returns

| 3 MO % | YTD % | 1 Year % | 3 Year % | 5 Year % | 10 Year % | SPSD % |

|---|---|---|---|---|---|---|

| 10.9 | 6.3 | 19.1 | 21.1 | 15.3 | 14.8 | 7.8 |

Performance as of August 31, 2025. Since Performance Start Date (PSD) - October 21, 1998. All information is in Canadian dollars. The performance presented is gross of management fees and administrative (fund) expenses and rates of return for greater than one year have been annualised. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends and distributions. Performance is historical and is not intended to be indicative of future returns.

The Highstreet Pooled Funds are prospectus-exempt products and are offered on a private placement basis. Units are offered on a continuous basis to investors who meet the definition of an ‘accredited investor’. Units of the funds are offered to residents in provinces and territories of Canada pursuant to exemptions set forth under National Instrument 45-106 from the prospectus requirements. Please read the offering memorandum before investing in Pooled Funds.